Supermoney App Remote Internship

Internship at a startup company, responsible for user research and assisting in UI interface drawing. In the process, I learned the existing domestic UI drawing style and technical standards for China mainland style.

Background Introduce

This startup hopes to enter the financial service recommendation app for Hong Kong and Southeast Asia in the future, and gain revenue through channel recommendation by connecting with the backend data of relevant financial institutions. The project service areas are planned to include credit cards, financial management, loans, and securities business, and may also plan to add insurance business in the future.

Currently, the main competitors in this field are the two platforms Hongkong Card and Moneyhero.

Competitive analysis

From the perspective of comprehensive service functions, response speed, and push notifications, there is no significant difference between the two.

The advantage of Moneyhero is that it takes the user's personal account as the core and provides a personalized experience of fast platform data interoperability. However, at the same time, it also requires users to register an account to use the app. It is no longer possible to use the app without registration, and it is mandatory for Hong Kong locals. Mobile phone numbers cannot be avoided.

Hongkong Card has more advantages in the richness and comprehensiveness of information, and has a more sophisticated UI design style. However, there are many advertisements and lack of interactive guidance, so novices may have a certain adaptation cost when using it.

User Channel Analysis

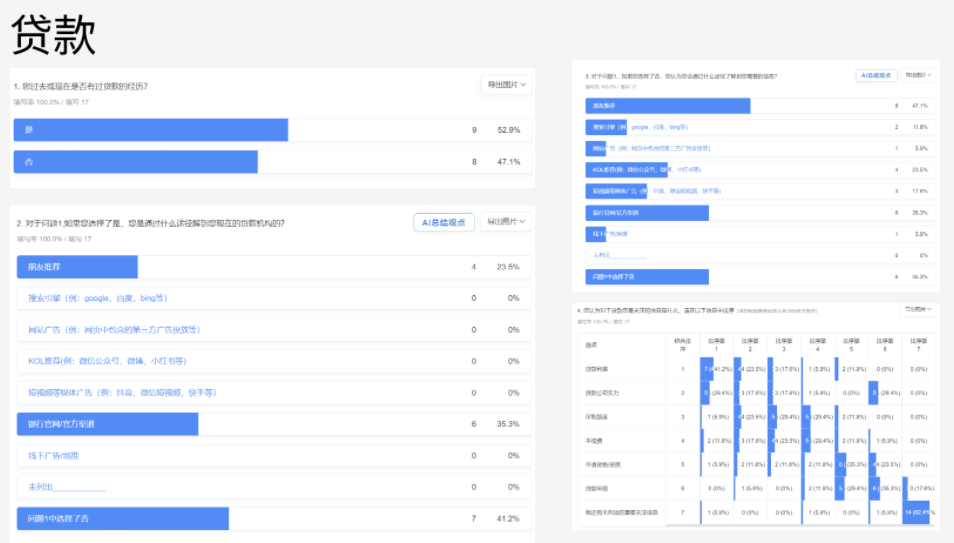

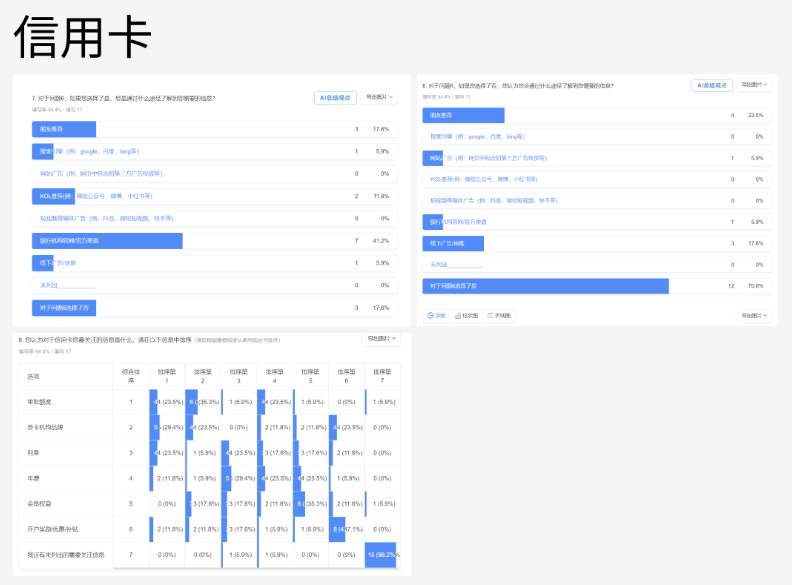

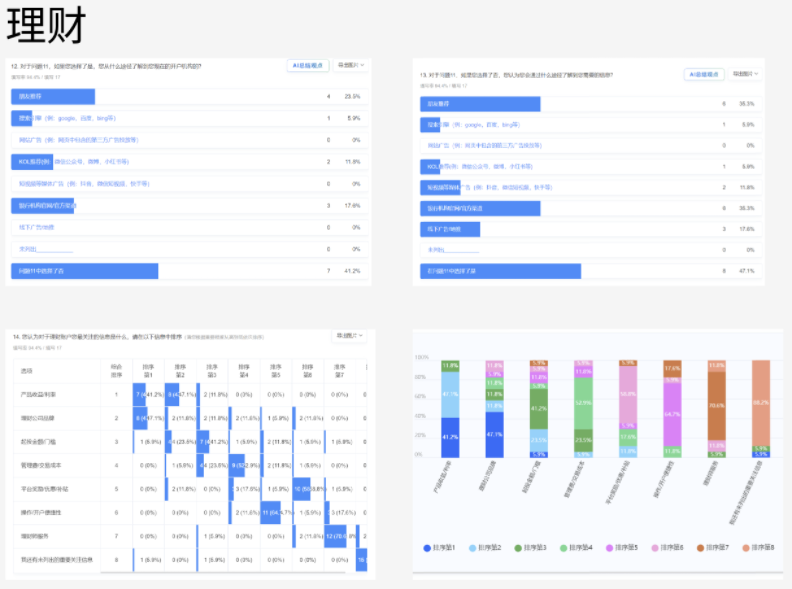

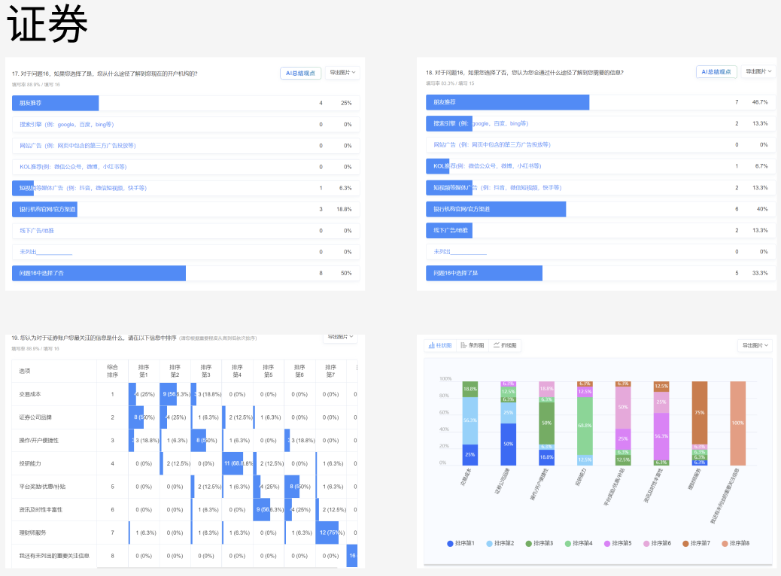

After analyzing the existing competitive products in the market, we also conducted a small-scale survey on users' trust channels for financial products in the form of questionnaires.

The questionnaire investigated the potential contact channels of users for loans, credit cards, financial management and securities and the actual contact channels of users in the past, so as to roughly understand the user's trust channels and guide traffic more efficiently.

Insights:

1. Bank official channels are the most popular choice, followed by recommendations from friends

2. Interest rates are the most important priority, followed by credit limits and institutional strength

Insights:

1. Credit cards are still the most popular choice, but recommendations from friends and marketing channels are starting to play a role

2. The card issuer is the top priority, followed by the credit limit and benefits

Insights:

1. In terms of financial accounts, word-of-mouth marketing and official accounts have the same proportion, and KOL and short videos may be potential growth points

2. Company strength and product interest rates are the most concerned points, while the minimum investment threshold and transaction costs are second.

Insights:

1. In terms of securities accounts, word-of-mouth marketing has exceeded the official value

2. Brand strength is an important concern, and transaction costs and account opening convenience are secondary concerns

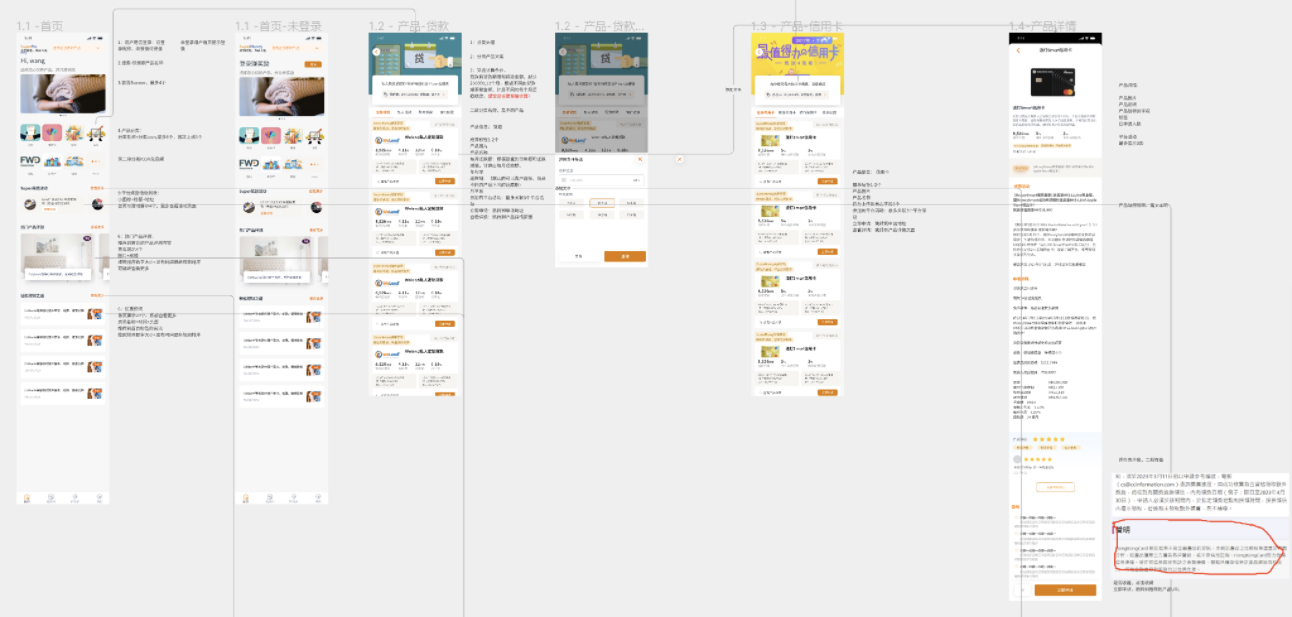

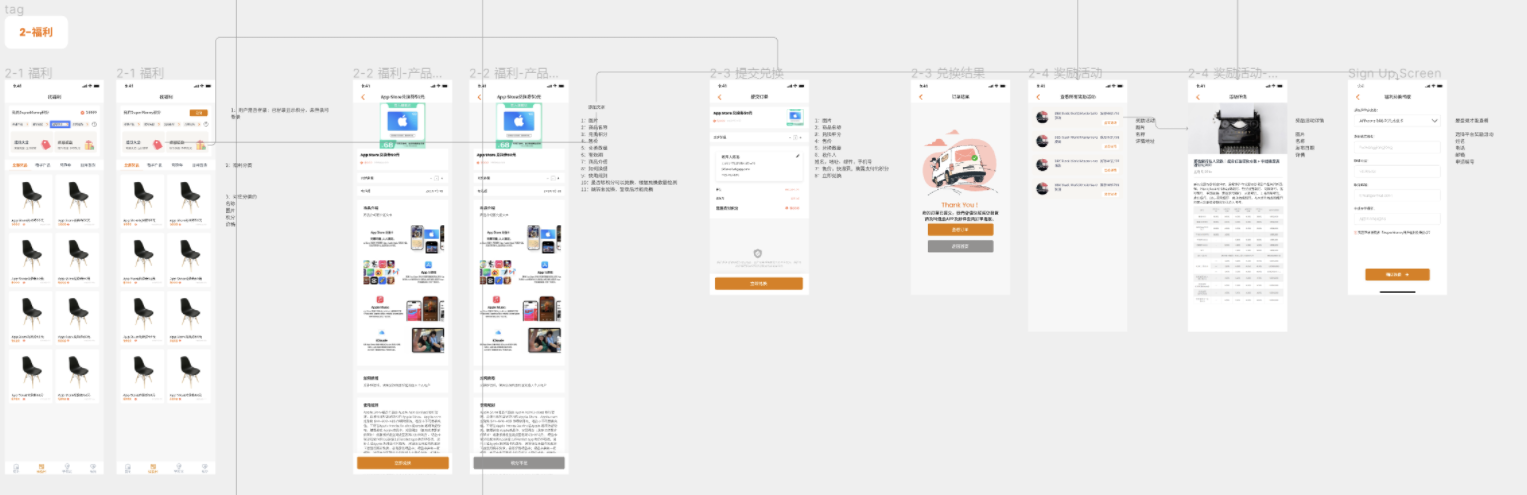

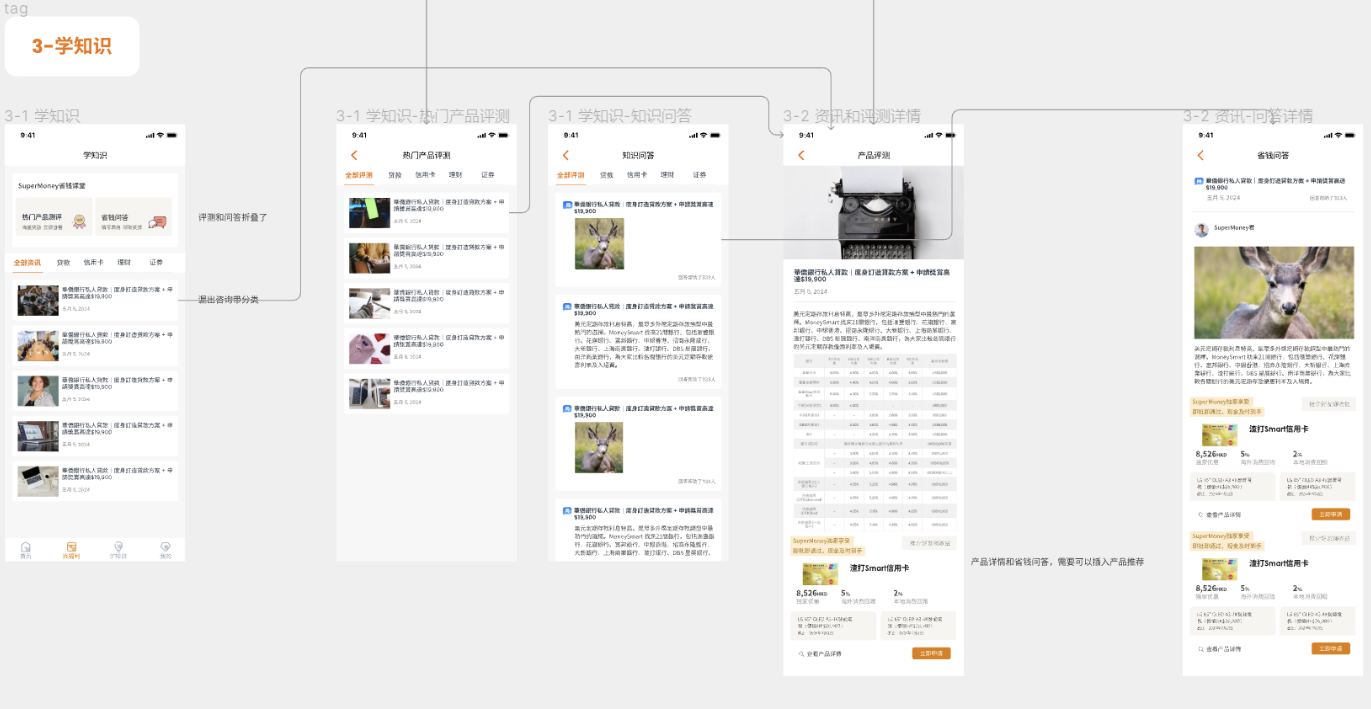

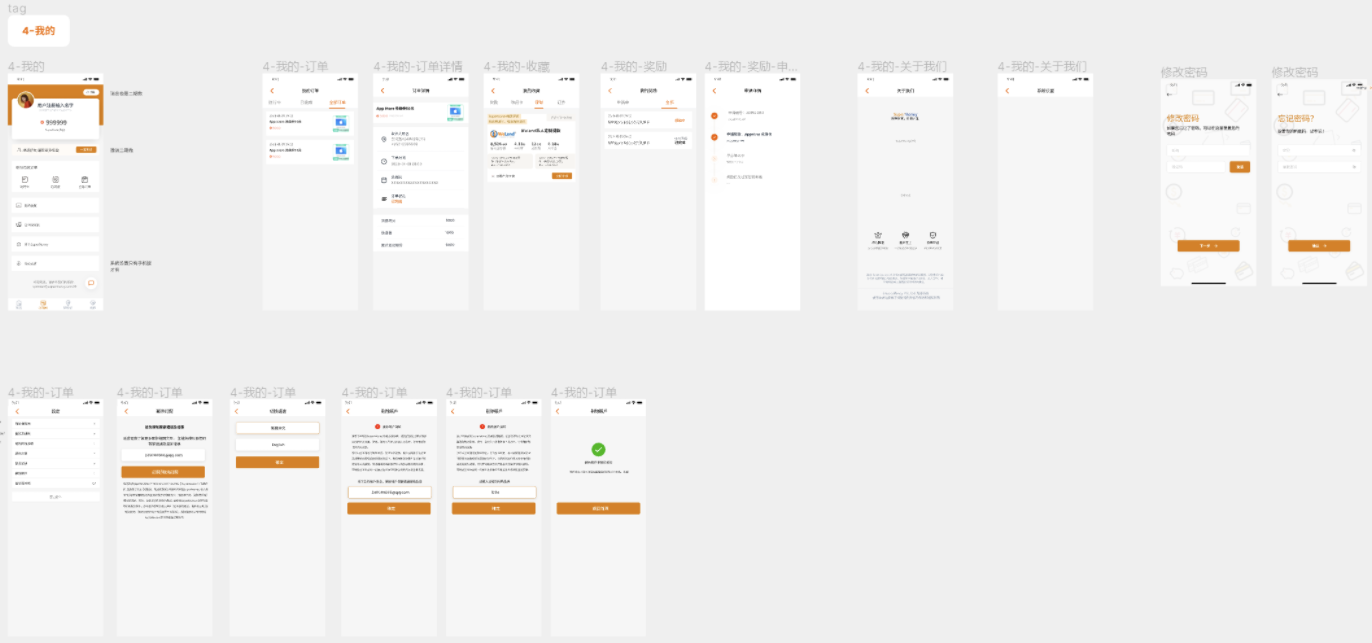

High-Fidelity Prototype

Since it was a startup company, we did not go through the process of writing Product Requirement Document and Requirements review meeting, so its skipped low-fidelity and went straight to prototype UI development.