Background Introduce

Scotiabank is one of Canada's prestigious five major banks and is an international bank with offices in over 50 countries, serving clients from around the world. Similarly, Canada has long been regarded as a country with excellent higher education resources, and the number of international students in Canada has been rising year by year. By the end of 2023, the total number of international students in Canada reached 1.04 million (CBIE, 2024). Therefore, international students are seen by Scotiabank as an important source of clients. Finding ways to attract more international student clients and encouraging them to use Scotiabank's services has been one of the bank's research priorities in recent years.

This project is commissioned by Kelly Keenan, the Product Design Lead at Scotiabank, who hopes we can explore ways to attract more international student clients to Scotiabank.

Project Goals

The goal of this project is to attract international students as customers. Our team will focus on studying existing customer issues, various help and support policies currently in place at major Canadian banks, and find growth points suitable for Scotiabank. The project will also strive to meet customer needs for existing Scotiabank services, incorporating improved accessibility and usability features into our design.

Preliminary research

We interviewed international students from multiple universities in Ontario and British Columbia through random questionnaires to learn about their existing financial service providers. We also searched online for public data to gain a comprehensive understanding of the current state of the financial industry, Canada's study abroad policies, and Canada's financial laws and regulations.

Data & Insights

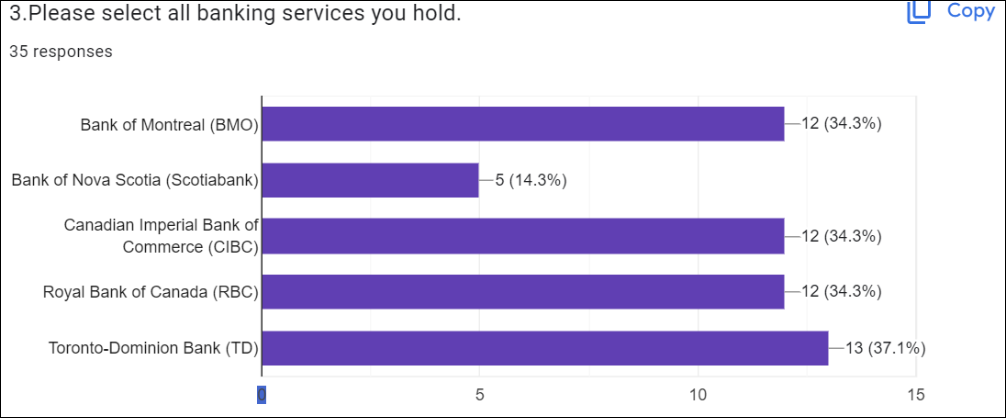

The first is clarify the current situation. In the 35-point valid questionnaire answer, Scotiabank's proportion of international students is indeed significantly lower than other competitors in the industry. This may be the reason why Scotiabank is eager to study a feasible improvement method.

(Although the data may still have bias due to the small sample size, the team aimed to minimize this by conducting distributed random sampling across more than five universities in Ontario and British Columbia, which together account for over 60% of Canada's population. The respondents also came from multiple countries, including China, India, and the Philippines, to further mitigate this issue.)

The second thing is to figure out who our users are?

*Students who plan to come to Canada on a student visa.

*People who currently have a Canadian study permit.

*Potential customers who are interested in switching from their current Canadian financial institution to Scotiabank.

In addition,

*Users who were international students in the past but have settled in Canada and have the next generation

How might We?

To summarize the above views, we believe that

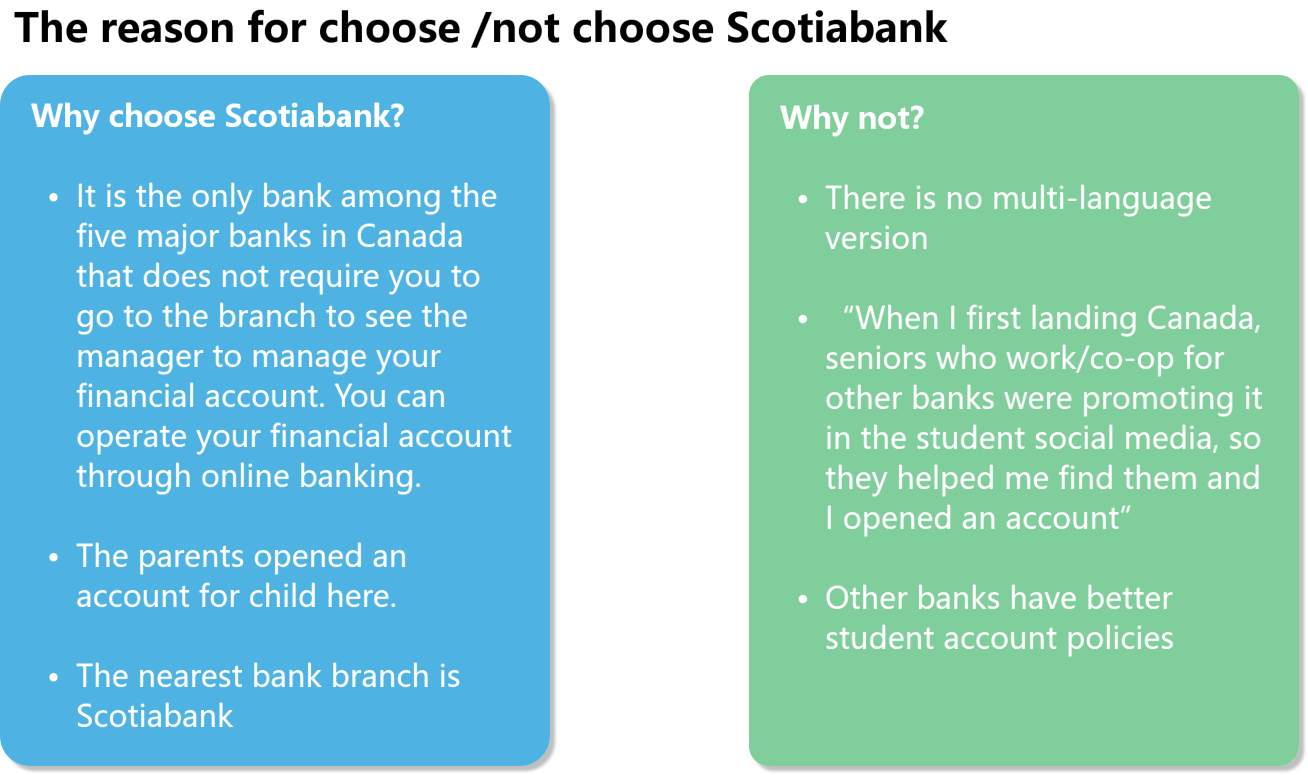

1. For new international students who have just landed, how to connect with them is the key to user growth. When the user does not have an available banking service, the bank that first connects with the student is likely to make the user a customer. Time and efficiency are the key.

2. For old users and potential users seeking to switch institutions, convenience is the key. This convenience may come from multiple aspects and the entire business process of the bank. That is, how to create the most freedom and the most competitive offers for users without violating relevant regulatory policies and laws and regulations will be the key.

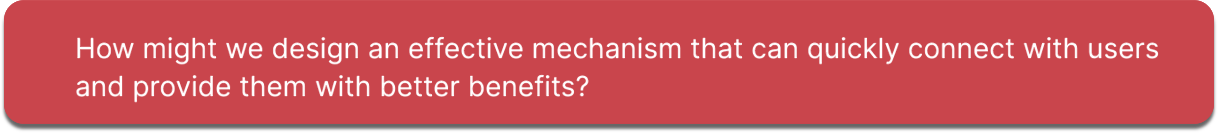

Therefore:

Create Solution

Based on the above preliminary research and questions, we believe that word-of-mouth marketing may be the most appropriate solution at present. In terms of establishing connections with new users, time and efficiency are the first priority. If existing Scotiabank users can spontaneously recommend Maple Leaf Bank to newly arrived international students around them because of certain rewards and incentives, Scotiabank will seize the initiative. And after each recommended person successfully opens an account in Scotiabank, the recommender will receive a certain reward, thus forming a virtuous circle.

Low-fidelity Prototype

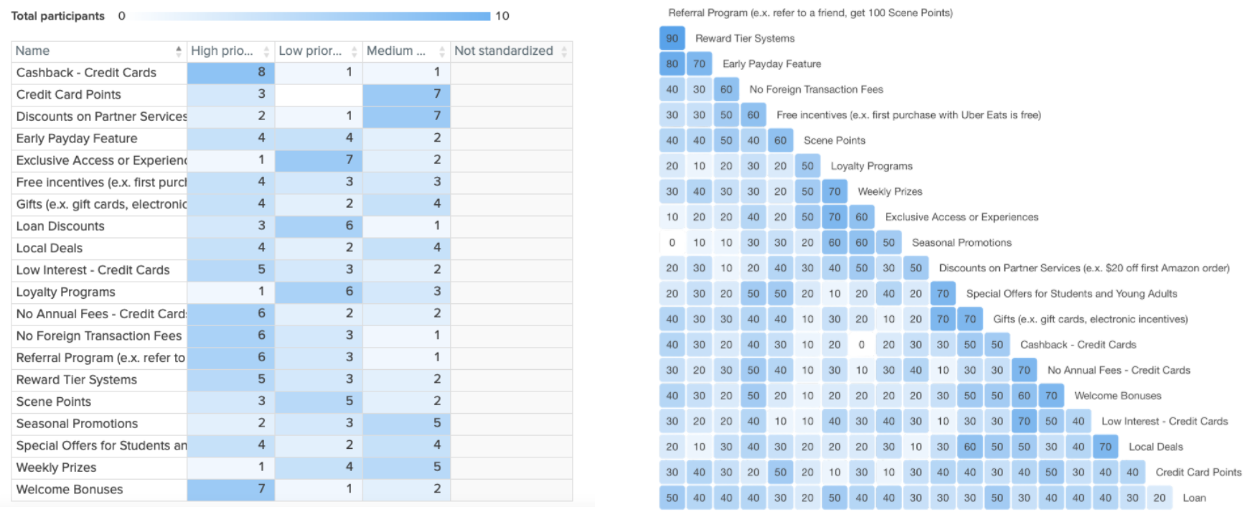

The card sort provided insights into app navigation and feature prioritization. It was divided into two parts, one focused on tasks and the other on incentives. We also conducted some Google Form surveys focusing on button placement layouts, providing qualitative and quantitative feedback to guide design decisions.

The main goal of this card sort was to gain insight into how users perceive and prioritize various features and tasks in the Scotiabank app. By analyzing how participants grouped and prioritized tasks, you can determine which features are viewed as the most important and valuable.

The second part had similar characteristics. The goal was to determine what types of incentives (e.g., cash back offers, loyalty points, service discounts, etc.) were most attractive to users, potentially influencing their engagement and loyalty to the app.

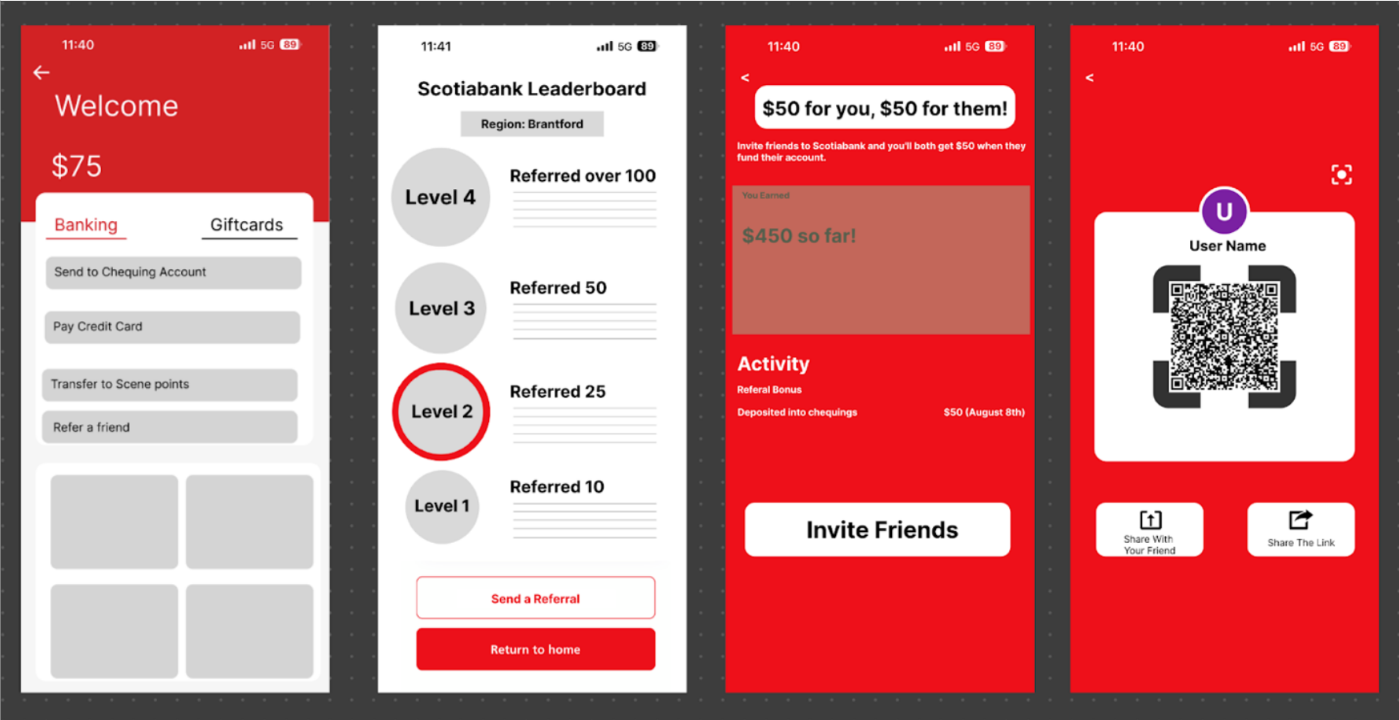

Mid-fidelity Prototype

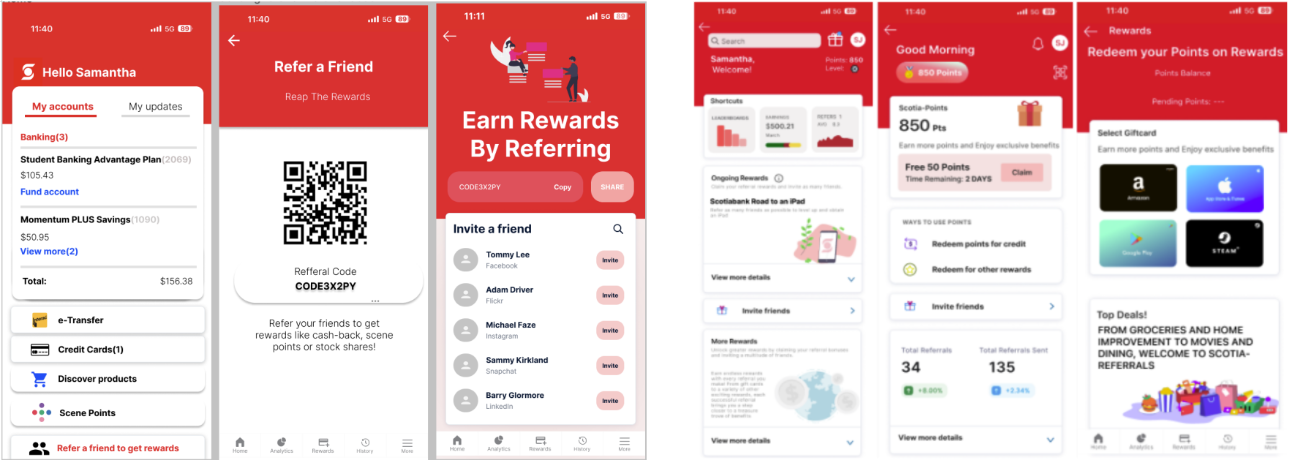

In the medium-fidelity stage, we continued refining our primary goal, which is the recommendation/onboarding process, aiming to provide users with a seamless experience as much as possible.

We divided the testing into two phases again, so our team would have a better chance of identifying any defects and usability issues in the prototype.

Phase 1: Task-based

In the first phase of our testing, we asked participants to perform the following tasks:

We wanted users to first browse through the various sections, send an e-transfer to a friend, manage their credit card payments within the app, and check their account balance and recent transactions. We encouraged them to freely explore the app. If they came across any new features that caught their interest, we asked them to let us know.

The selected tasks prompted participants to navigate through the most frequently mentioned features in our card sorting test.

Results

In the first phase, we recruited 18 participants and evaluated them based on whether they found the recommendation button and proceeded to onboard someone. The criterion for success was whether they completed the task, i.e., pass or fail. Overall, only 3 out of 18 participants were successful, with a success rate of 17%.

We held a quick post-test interview with all participants. For those who were unsuccessful, we asked a series of questions to determine whether they noticed the recommendation button and why they never clicked or acted on it.

To our surprise, many participants did not know what the feature was for and didn't see a reason to click it. Once we familiarized them with the concept, they became more interested and acknowledged it as a useful feature. Therefore, the issue lies in its visibility. By adding a pop-up suggestion on the main screen, the feature would become more visible, accessible, and beneficial to users.

After making these iterations and adjustments, we hope to expand the results in the second phase of testing.

Phase 2:

In this phase, we asked participants to explore the app as if they were using it to meet their daily banking needs. We asked them to first familiarize themselves with the various available features, share their thoughts on the app's layout while browsing, and comment on ease of use and appealing features. We further encouraged them to freely interact with any features that seemed interesting, especially those that appeared relevant to their needs. We then asked them to explain how they discovered new features and the decisions they made when determining which features to use.

High-fidelity Demo